how to pay indiana state tax warrant

Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following. About Doxpop Tax Warrants.

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

If your account reaches the warrant stage you must pay the total amount due or accept the.

. An official website of the Indiana State Government. You can set up a. What is a tax warrant.

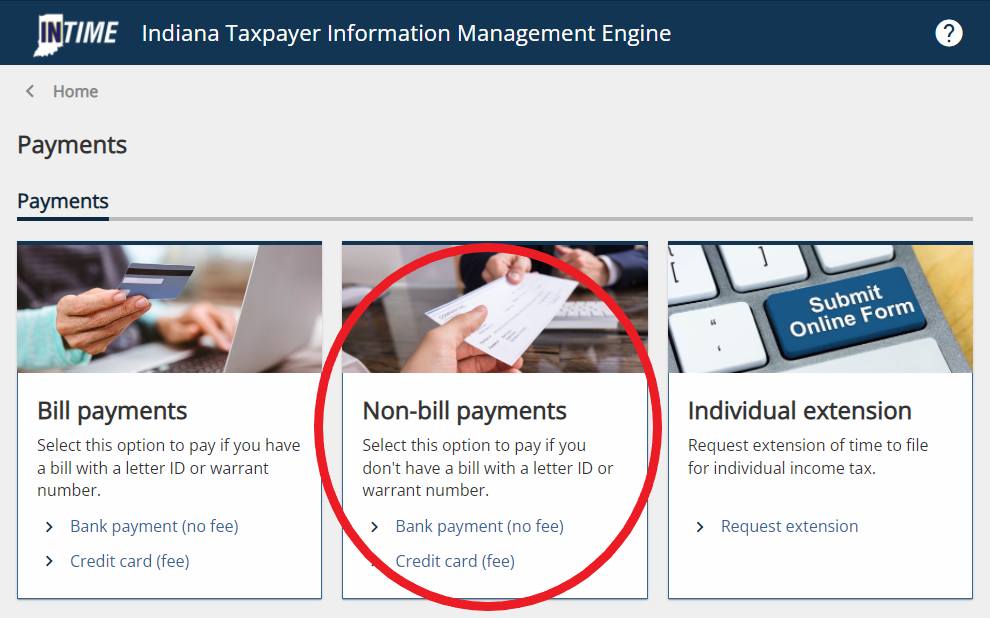

The Service this Tax Warrant Collection System provides is solely based on and reliant upon human and technical resources that are within the State of Indiana. The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. Pay by check or money order.

There are three types of bills. If you have questions about your Indiana tax warrant you can call the Indiana DOR at 317-232-2240. Access to the INcite e-Tax Warrant application through a public terminal in the circuit clerk s office or other public access to tax warrants.

Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. Doxpop provides access to over current and historical tax warrants in Indiana counties. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional.

For current balance due on any individual or business tax liability you may call the automated information line at 317-233-4018 Monday through Saturday 7 am. If you are disputing the amount owed call the Department of Revenue at 317-232-2240. We will also notify the Department of State that the tax warrant has been satisfied.

Find Indiana tax forms. Whether the warrant was properly issued according to statute or DOR procedures. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Know when I will receive my tax refund. Pay your Indiana tax return. When a Tax Warrant becomes a Court Case.

Property that is illegal to possess. Know when I will receive my tax refund. You must pay your total warranted balance in full to satisfy your tax warrant.

Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your state taxes you must contact them immediately to avoid a court. Find Indiana tax forms. Whether the taxpayer owed the tax for which the warrant was issued.

A tax warrant is equivalent to a civil judgment against you and protects New York States interests and priority in the collection of outstanding tax debt. Do not call the Hamilton County Sheriffs Office as this agency has nothing to. These taxes may be for individual income sales tax withholding.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Check status of payment. If a collection agency handles your tax warrant.

Whether the warrant is subject to any. Indiana State Tax Warrant Information. Our service is available 24 hours a day 7 days a week from any location.

How do I pay a tax warrant in Indiana. Make a payment plan payment. Follow A tax warrant is a notification to.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency.

Sheriff Sales Huntington County Indiana

Dor How To Make A Payment For Individual State Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Guide To Wisconsin Dor Tax Payment Plan

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Dor Completing An Indiana Tax Return

Indiana Tax Warrant Joseph Pearman Attorney At Law

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Florida Dor Tax Resolutions Consequences Of Back Taxes

State Tax Lien Removal How To Remove A Tax Lien After Bankruptcy

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

Jill Glavan On Twitter Why Is The State Of Indiana Issuing Tax Warrants To An 11 Year Old Girl Her Mom Contacted Cbs4problemsolvers For Help And We Found Out It S Perfectly Legal I Ll Break

Estimated Income Tax Payments For Tax Year 2023 Pay Online

Lien Theory Vs Title Theory Proplogix

Scam Alert Fraudulent Tax Letters Claiming Distraint Warrant Cattaraugus County Website

Indiana Tax Sales Tax Liens Youtube