san francisco payroll tax withholding

Federal income tax does not need to be withheld from the final pay. Normally tax withholding is taken care of by your employer and you dont have to think about it says Rachel Elson an associate financial planner at.

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Unemployment Insurance UI The 2022 taxable wage limit is 7000 per employee.

. If the wages are paid in the following year they are not subject to FICA FUTA or. If your federal tax liabilities for the bonus payroll are over 10000000 the taxes must be deposited the business day after the check date. Born August 6 1976 is an American businessman best known as the co-founder and former chief executive officer CEO of UberPreviously he worked for Scour a peer-to-peer file sharing application company and was the co-founder of Red Swoosh a peer-to-peer content delivery network that was sold to Akamai Technologies in 2007.

Learn more about how to process a bonus payroll here. Pull your payroll liability report Pulling your payroll liability report on a monthly basis and comparing it to your proof of tax deposits can help you keep track of any taxes you. Choose Office of the President UCOP only if you are a UCOP employee.

The UI tax rate for new employers is 34 percent 034 for a period of two to three years. The UI maximum weekly benefit amount is 450. Choose Non-UC External User if you are not a UC or UCOP employee.

Zenefits is an award-winning People Ops Platform that makes it easy to manage your employee documents HR benefits payroll time and attendance and benefits all in one secure place. Travis Cordell Kalanick ˈ k æ l ə n ɪ k. Raff director of the tax department at Northfield Illinois-based Gordon Law Group Ltd said those moves can have implications for income sales and payroll taxes depending on the.

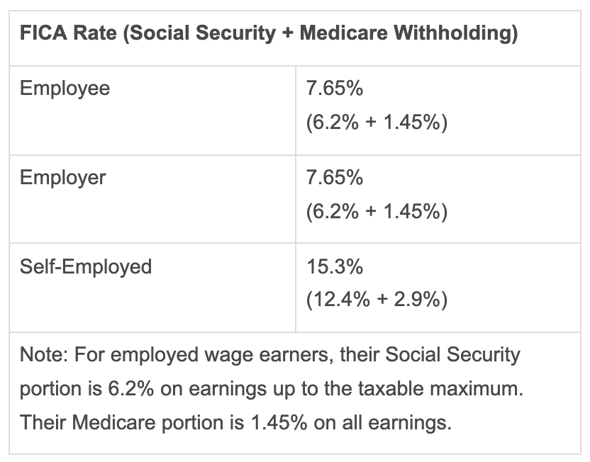

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

What Are Employee And Employer Payroll Taxes Ask Gusto

Payroll Tax Analyst Resume Samples Velvet Jobs

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2021 Wage Base Rises For Social Security Payroll Taxes

7 Easy Payroll Remittance Form Sample Payroll Payroll Taxes Form

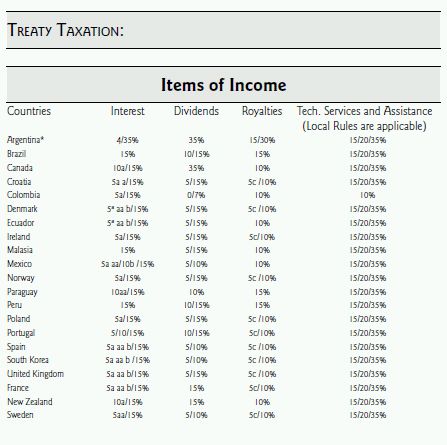

Managing Corporate Taxation In Latin American Countries Chile Tax Chile

How To Calculate Payroll Taxes For Your Small Business The Blueprint

2022 Federal State Payroll Tax Rates For Employers

Different Types Of Payroll Deductions Gusto

Can I Set Up A Payment Plan For Unpaid Payroll Taxes

California Payroll Taxes Everything You Need To Know Brotman Law

Salary Paycheck Calculator Payroll Calculator Payroll Paycheck Salary

2022 Federal State Payroll Tax Rates For Employers

Pin On Irs Tax Debt Relief Tax Settlement

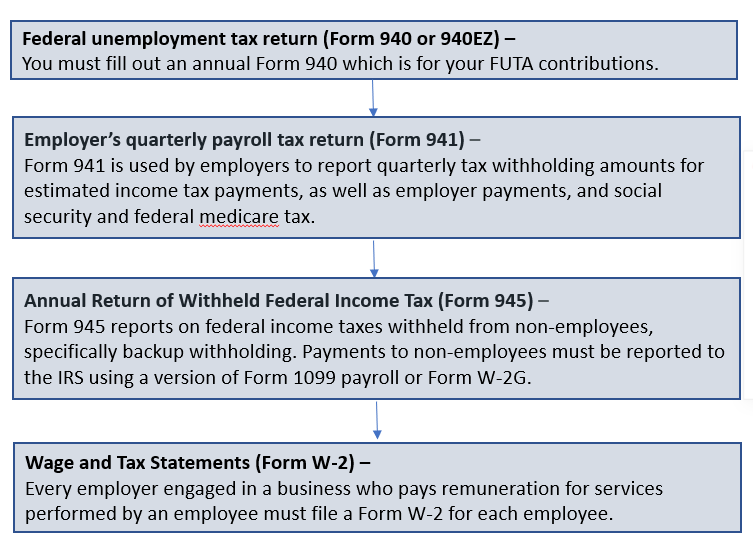

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Payroll Tax Vs Income Tax What S The Difference The Blueprint